Watching the markets and how they have been behaving these past few weeks, I feel we are at a crucial junction for global markets.

China and the United States are at a point where a compromise could hold significant mutual benefits. The recent visits of U.S. Treasury Secretary Janet Yellen and U.S. Secretary of State Anthony Blinken to China underscore the importance of this potential solution.

China is grappling with a severe banking crisis. Official reports suggest that non-performing loans (NPLs) are under 2%, but the actual losses might exceed 10%. This discrepancy points to deep-seated financial issues that need to be addressed. To keep its banking system operating seamlessly, China has two main options:

One, it could further expand its fiscal policy, which already has a 7% deficit. This approach would likely balloon its money supply (M2) to between $50 and $60 trillion, 3x China’s GDP, risking severe inflation.

Alternatively, China could use bank depositors' savings to recapitalize its banks in the form of a bail-in. This action, however, would most likely create unrest and reduce consumer spending, which currently makes up 38% of GDP. This reduction in spending would worsen the recession triggered by the bail-in and accelerate capital flight. Until now, capital controls have made it hard for the Chinese people to take their money out of the country, but not impossible.

But one could ask, why now? Haven’t the Chinese banks been in “trouble” for so long?

All this has come to surface because the U.S. Dollar has grown stronger. America's fiscal and monetary policies have driven the U.S. Dollar higher, creating a global U.S. Dollar shortage. (See my post “The Chronicle of an Upcoming U.S. Dollar Squeeze” - November 6 2023)

The last thing China wants now is for the U.S. Dollar to strengthen. This surge is a double-edged sword for China: Firstly, it amplifies the downward trajectory of the Chinese Yuan, potentially precipitating inflation and eroding confidence in the nation's economic stability. Secondly, it depreciates the value of the Japanese Yen, making Japanese goods more competitive on the global stage. This situation poses a threat to China's export sector, which traditionally has served as the principal conduit for U.S. Dollar inflows, particularly in light of the substantial decline in foreign direct investment (FDI) into the country.

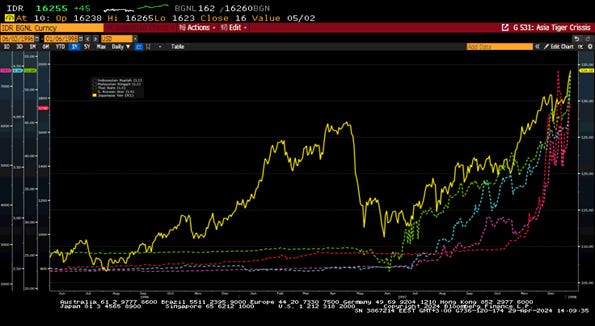

The devaluation of the Japanese Yen in the mid-1990s played a pivotal role in triggering the Asian Tiger Crisis of 1997. As the Yen depreciated, Japanese exports became cheaper, undercutting the competitiveness of other Asian economies' exports. This led to widening trade imbalances and increased vulnerability to external shocks. Capital flight emanated as investors withdrew funds from the region, exacerbating currency depreciation and financial instability.

The interconnectedness of Asian economies magnified the impact, sparking a domino effect of currency devaluations and financial crises across the region, culminating in the broader Asian financial meltdown.

Asian Currencies 1996 -1998 (Yen in yellow)

On the other hand, the U.S. is in an expansionary fiscal phase and needs foreign investors to continue purchasing its bonds. With the U.S. elections looming in November, the U.S. government has a vested interest in maintaining stable international financial markets and avoiding a crisis.

Given these dynamics, both nations, the U.S. and China, have a strong incentive to find some form of temporary compromise. One needs U.S. Dollar liquidity to avert a financial crisis, and the other needs foreign investors to buy U.S. Treasuries and prevent a global market correction.

However, both sides may refrain from publicizing a potential compromise due to political considerations, as its disclosure could lead to domestic political challenges.

Similar to the undisclosed Shanghai Accord of 2016, G7 countries could agree to mitigate the strengthening of the U.S. Dollar, thereby alleviating global economic pressures.

For all that, discerning the existence of such an agreement presents a challenge. One potential indicator could be the performance of the Japanese Yen, which has depreciated by over 10% against the U.S. Dollar since the beginning of this year.

Should the Yen suddenly reverse its trajectory, it could suggest an undisclosed compromise between the two major powers.

As these nations' financial narratives unfold, the Yen may serve as a crucial signal for market participants seeking clarity.

Japanese Yen Today

Michael, the thing is, it is not clear to me that absent actual policy changes by the nations involved, they will be able to adjust the dollar lower. certainly the ECB and BOE and PBOC cannot raise interest rates, and it appears that the Fed will have a tough time cutting them, at least for now. so while they may talk a big game, unless the talk includes clear actions to intervene regularly (which I seem to doubt based on history, especially in the US) it is not clear to me what can break this link.

Now, if Powell does cut soon, especially with inflation still hot, then the dollar will certainly fall, while hard assets will rally. but I find it hard to believe that is the next move

I address all this in my piece